For several months, numerous rumours have been circulating about the future of the 4200 customs regime in France. At RM Boulanger, we sought to obtain an official clarification.

It is important to note that the issue at stake is not the continuation of the 4200 customs regime itself, which will remain in place after 1 January 2026. The real question has been under what conditions, and by which companies, it can still be used once the limited tax representation arrangement is withdrawn for non-EU companies.

It is precisely the combination of these two mechanisms – the 4200 customs regime and limited tax representation – that has allowed foreign companies to import into France under the DDP (Delivered Duty Paid) Incoterm. With the announced end of limited tax representation for non-EU companies, this possibility will no longer exist.

The uncertainty specifically concerned companies established outside the EU but in a country with a tax cooperation agreement with France (e.g. the United Kingdom). Could they be treated in the same way as EU companies and continue to benefit from ad hoc tax representation, as is the case for those exempted from “general” tax representation?

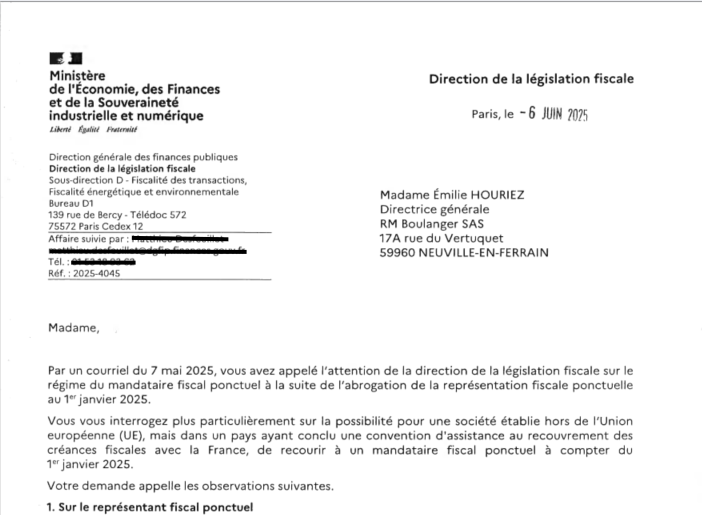

To remove this uncertainty, we directly questioned the Directorate of Tax Legislation (DLF), which confirmed in writing that companies established outside the European Union – including those based in a country with a tax cooperation agreement with France – will no longer be able to use ad hoc tax representation to import into France and deliver their goods within the EU.

Snippet of the official letter received from the French tax administration

What does this means exactly?

This means that, as of 1 January 2026, the companies concerned will no longer have access to the 4200 regime for DDP operations via France.

The response we received puts an end to any uncertainty: from that date, imports under DDP via France can no longer be carried out under the 4200 customs regime by companies established outside the EU. This includes those exempted from general tax representation and, therefore, companies established in the United Kingdom.

What this means for UK and non-EU exporters:

Non-EU companies will need to review their import procedures into Europe.

DDP flows via France, previously facilitated by the 4200 regime, will need to rely on other compliant solutions.

Anticipating these changes is essential to avoid disruption to deliveries from 2026.

No cause for concern

RMB already has solutions

At RM Boulanger, we have grouped our alternatives under one name:

Plug 2 EU

Plug 2 EU is a suite of practical solutions, designed for both SMEs and large groups, to ensure you can continue delivering to your European customers in full compliance after 2025.

Our experts are ready to support you in analysing your current flows, identifying the best alternative, and implementing the solution most suited to your business.

Prepare today for the 2026 transition!

Do not let the January 2026 deadline take you by surprise. Our teams are here to guide you and secure your operations in Europe.

Contact RM Boulanger today to anticipate your future obligations and discover Plug 2 EU.