The General Directorate of Customs and Indirect Rights has recently announced the adjusted excise duty rates for 2024 on alcohols and alcoholic beverages in France.

This update is crucial for businesses, importers, and consumers of alcoholic beverages. Here's an overview of the major changes to consider:

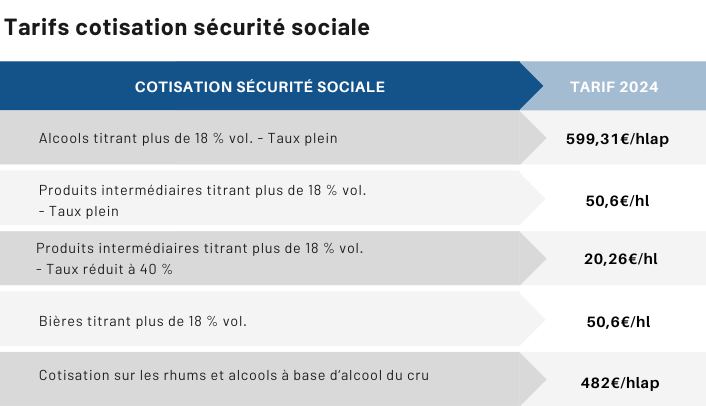

- Change of Rates: The rates have been adjusted to align with France's economic and public health objectives. A maximum increase of 1.75% has been applied this year. This affects various categories of alcohols, including beer, wine, spirits, and other alcoholic beverages.

-

Consequences for Importers: Importers of alcoholic beverages in France must be aware of these changes to avoid customs and financial complications.

lso, since January 1, 2024, the collection of excise duties on alcohols and tobaccos falls under the General Directorate of Public Finances (DGFiP).

For more information, you can consult the official website of the French customs here.

It is essential for all market players to stay informed of these changes to ensure compliance and optimise their business strategies. To gauge the impact this will have on your company, we invite you to get in touch with one of our experts as soon as possible.