E-commerce

OSS / IOSS

Various changes exposed

1. The threshold changed

The turnover threshold that determines in which country VAT is due is changed.

You will need to collect VAT in all EU countries you ship goods to when your total turnover exceeds € 10,000.

- You will need to be registered and declare VAT in all countries where you sell, except when using OSS (optional)

- You must know the VAT rates of your products in all countries of sale.

2. VAT obligations are transferred to marketplaces

If some of your sales are made through a marketplace, in some cases, it is this marketplace that will collect and report the VAT on your sales. Please note, all sales made via marketplaces will not be affected.

- You must identify in which cases the marketplace will manage the VAT for you to avoid double collection of VAT;

- You must modify your invoicing when the marketplace will be in charge of the VAT on the sale.

3. New VAT regime for distance sales of imported goods

If you ship goods that have been previously imported to your customers, you may be affected by the new system for distance sales of imported goods.

- You must identify which sales are affected, in particular according to the journey of the package to the individual customer (stock in the EU or not);

- You must identify whether you, the individual customer or a possible marketplace is responsible for managing the VAT due on importation;

- You must identify whether VAT is to be collected on the sale, by you or a marketplace, in which country and at what rate;

- You have to choose whether or not to use IOSS.

4. The new “IOSS” for distance sales of imported goods

These counters are optional and simplify the declaration of VAT on sales made.

- You must identify the sales that can be reported through OSS or IOSS;

- You should determine whether you have an interest in using OSS and / or IOSS;

5. Low-value goods

Low-value goods (over €22) no longer qualify for VAT exemption. The VAT exemption they were eligible for has been abolished. You should take this into account when determining your selling price and/or inform your customers of this additional cost to avoid unpleasant surprises.

6. VAT-obligation matrix

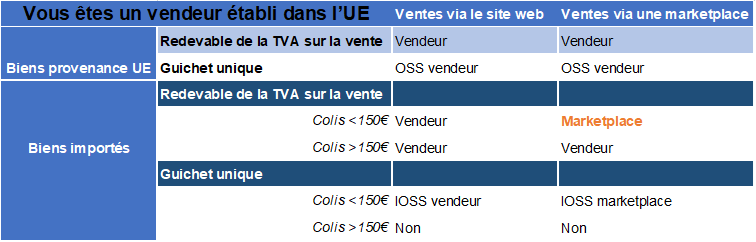

1.1 You’re a seller, established in the EU

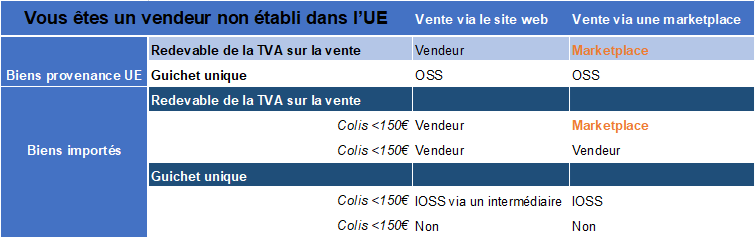

1.2 You’re a seller, non-established in the EU

6. Matrice d'obligation de TVA

1.1 Vous êtes un vendeur établi dans l'UE

1.2 Vous êtes un vendeur non établi dans l'UE