Are you familiar with the future

E-invoicing obligations ?

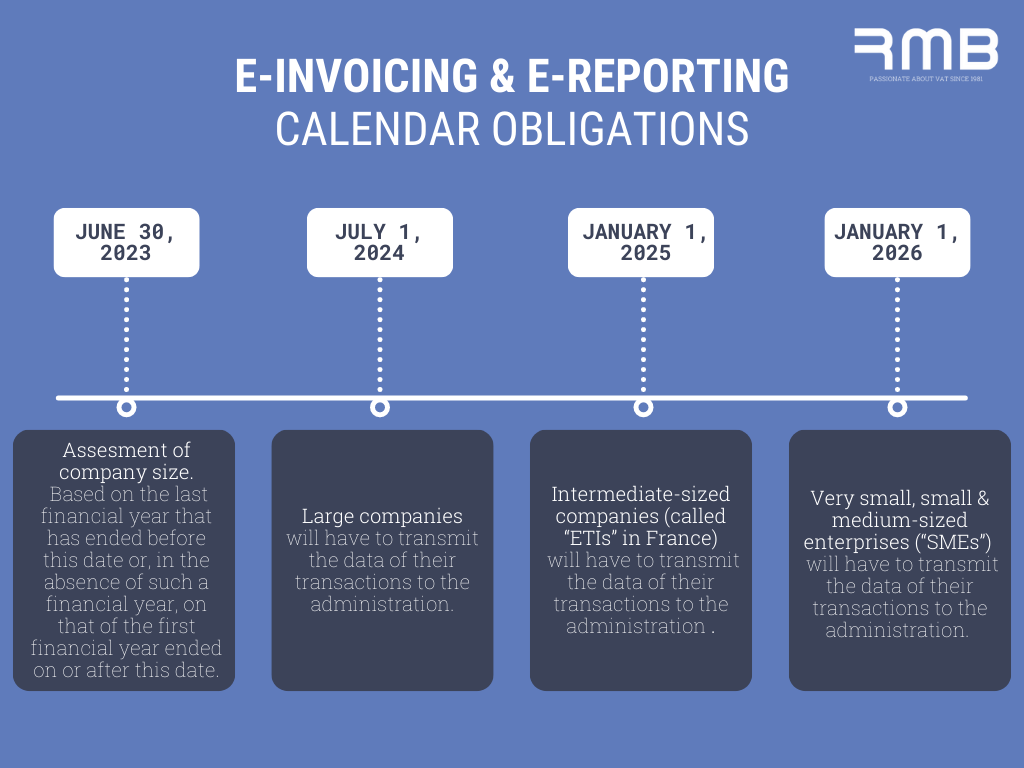

France has introduced the e-invoicing obligation for French companies according to a timetable that begins on 1 July 2024.

Depending on their size, French companies will gradually be obliged to issue electronic invoices, and by 1 July 2024 they must all be able to receive electronic invoices.

Foreign companies are not affected by this electronic invoicing obligation. However, they are fully concerned by another obligation: the electronic transmission of data to the tax authorities.

he electronic transmission will concern all international B2B and B2C transactions as well as intra-EU B2B invoices. Depending on the size of the foreign company, it may be applicable as of 1 July, 2024.

The timetable for the introduction of electronic invoicing and electronic transmission is the same.

In order to meet these obligations, companies will have to use either the public invoicing portal (Chorus Pro) or a private dematerialised platform.

The size of the company is assessed according to the following (French) criteria:

► A microenterprise is a company whose workforce is less than 10 people and whose turnover or annual balance sheet total does not exceed 2 million euros;

► An SME is a company whose workforce is less than 250 people and whose annual turnover does not exceed 50 million euros or whose balance sheet total does not exceed 43 million euros;

► An ETI, is a company that does not belong to the SME category, whose workforce is less than 5,000 people and whose annual turnover does not exceed 1,500 million euros or whose balance sheet total does not exceed 2,000 million euros;

► A large company is a company that cannot be classified in the previous categories.

The notion of company used above refers to a legal unit, a legal unit being identified by its Siren number. All companies established in France or all foreign companies VAT registered in France, have a Siren number.