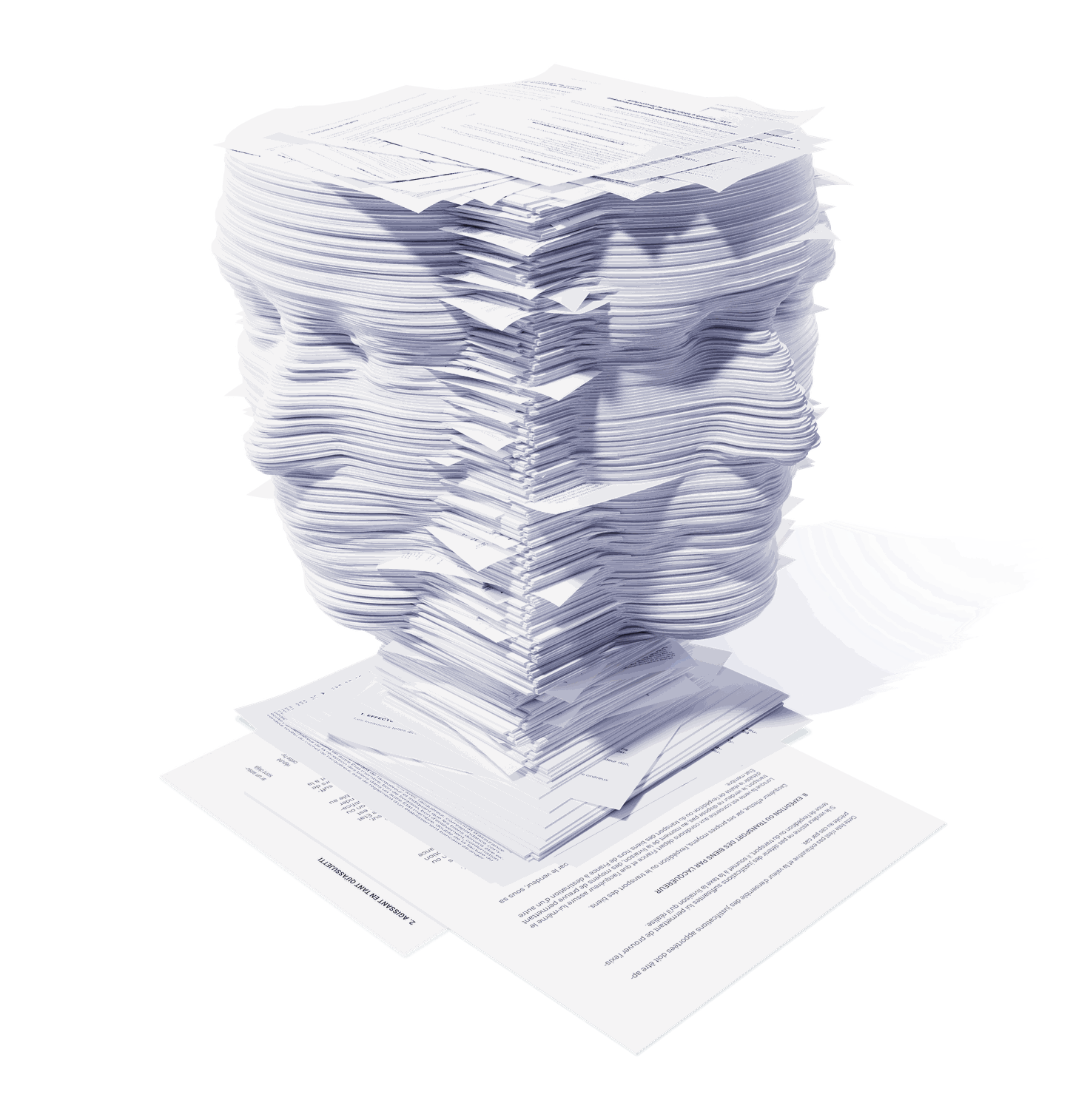

While you conquer

international trade

RMB will handle the paperwork!

Find out about VAT and Customs regulations in the EU. RM Boulanger assists you in your fiscal and customs formalities.

Find all information per theme & country.

Everything about VAT registrations, Intrastat, fiscal formalities and more to start your activities in one of the 27 Member States of the EU.

Each country has its own regulations and requirements for the collection and reporting of VAT. Find out which ones concern your company and how we can assist.

Find out what are the different eco-contributions, how they are collected as a tax what the process is and whether your company is affected or not.

Are your

representing clients ?

Every company has its core business, and stives to excel in its own domain. Our passion is VAT and the movement of goods across the invisible borders of Europe and beyond.

Putting our passion to work is what keeps us going every day, and what keeps our clients compliant and happy. Are you looking for support in the complex matters of VAT for one or several of your clients?

HOW CAN WE HELP YOU TODAY

Do you have questions about how RMB can help your business?

Send us an email and we’ll get in touch with you shortly, our VAT experts are always happy to help.

You can also contact us by phone: +33 3 20 25 70 70.

Book your call with our experts

You can book a call with one of our experts to assess your fiscal situation

We offer a first check up for free, no obligations attached

CONTACTEZ-NOUS DES AUJOURD'HUI

Vous avez des questions sur la manière dont RMB peut aider votre entreprise ?

Envoyez-nous un mail et nous vous contacterons rapidement.

Nos experts en TVA sont toujours heureux de vous aider.

Vous pouvez également nous contacter par téléphone : +33 3 20 25 70 70.

Réservez votre appel avec nos experts

Vous pouvez prendre rendez-vous avec l'un de nos experts pour évaluer votre situation fiscale.

Nous vous proposons un premier bilan gratuit, sans engagement de votre part.